X

SAP S/4 HANA Financials: what is new in Controlling – explained simple

What is SAP S/4 HANA Financials

This is a new financial SW version introduced by SAP SE to support the processes of financial planning and accounting, management accounting, financial supply chain management and material valuation and to replace its predecessor „SAP Simple Finance“.

Key benefits of SAP S/4 HANA Financials

- Real-time analytics based on a „single-source-of-truth“

- Increased performance esp. in the month-end-closing and reporting

- Intuitive user experience on all devices incl. mobile phones

- Improved integrated planning process

- Elimination of data redundancy trough merging the data to a single data source

SAP S/4 HANA Process changes in Controlling

- All cost elements – primary and secondary are created via GL account master data. The transactions KA01 and KA06 are not available anymore.

- The process of month-end closing (e.g. settlements, allocations) remains the same. The speed of the process steps has been significantly increased.

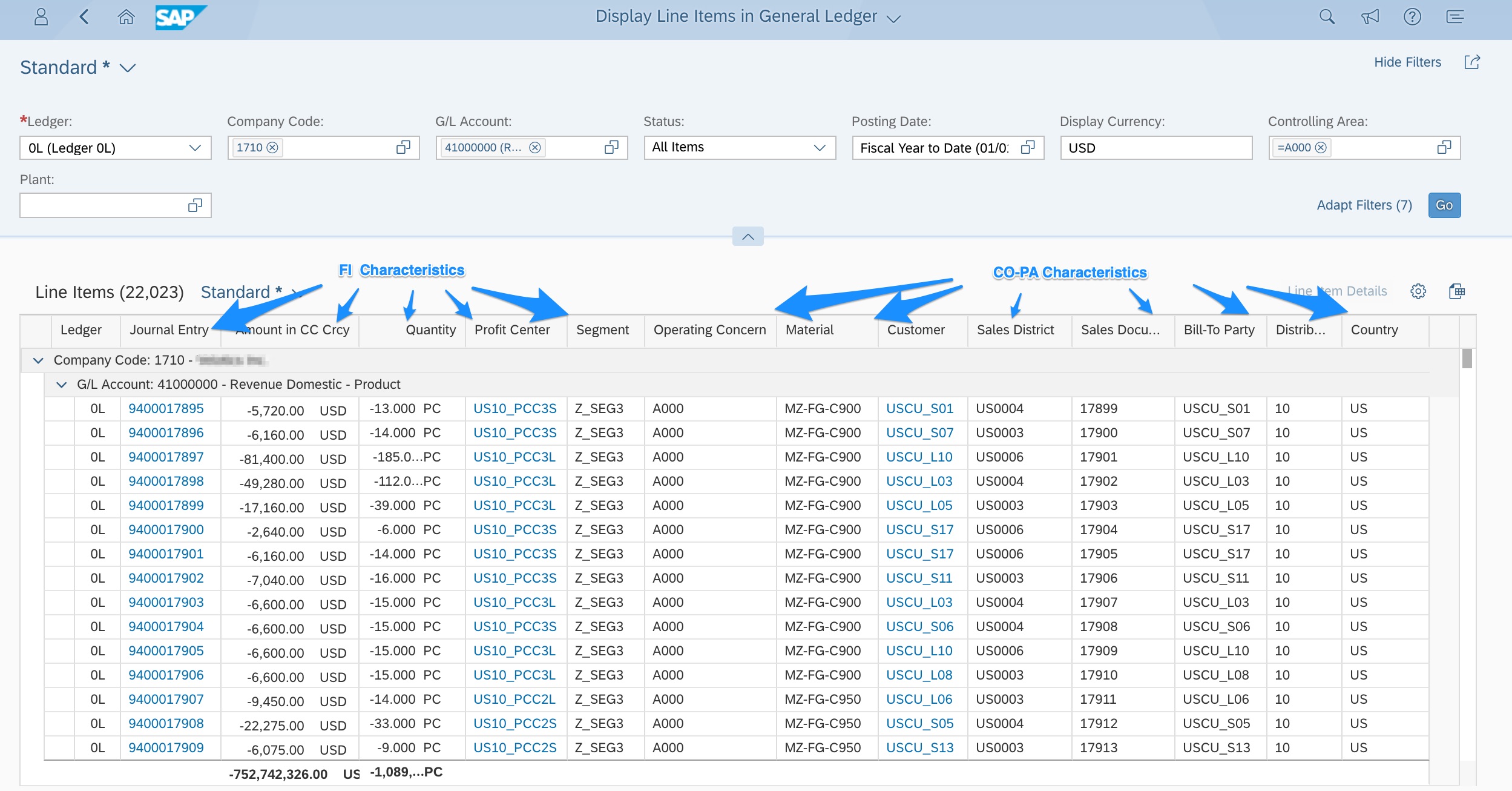

- There is no need for FI-CO-COPA reconciliation using CO reports. All CO assignments are available on FI line item level in FI Universal Journal. Universal journal allow a multi-dimensional analysis and reporting using FI and CO characteristics.

This picture shows how the Universal Journal looks like (this is just an extract of some characteristics): double click to enlarge

SAP S/4 HANA Technical changes in Controlling

- Actual data (value type = 04) that was formerly in COEP (CO line item table) is now in ACDOCA (universal journal)

- Statistical data (value type = 11) is stored in additional columns in ACDOCA (universal journal) and in COEP for compatibility access

- Totals tables for primary costs (COSP) and secondary costs (COSS) are replaced by views

- Actual data for long running orders and projects that were in COSP_BAK and COSS_BAK (back up for former totals tables) is now in ACDOCA

- Value types other than 04 and 11 continue to be stored in COEP, COSP_BAK and COSS_BAK (examples include planned costs and target costs)

- Table header COBK is updated as before

- There are new entries created for secondary cost elements in the tables SKA1, SKA2 and SKAT. A new field for the account type (GLACCOUNT_TYPE) is added to table SKA1 in order to classify G/L accounts by their type (e.g. balance sheet account, primary cost element etc.)

- Reduced memory footprint (elimination of totals tables and aggregates)

GL accounts and Cost elements in SAP S/4 HANA Financials

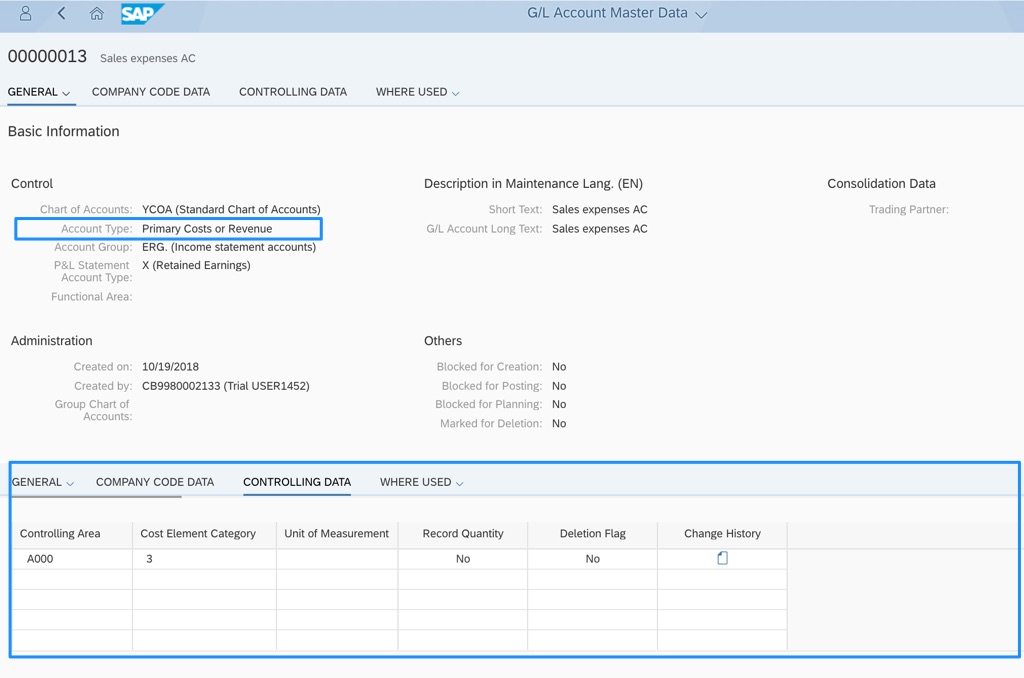

With S/4HANA Financials all cost elements become GL accounts. When a GL account is created it is classified by cost element category. The following categories are available:

- balance sheet account

- non-operating income/expense

- primary costs/revenue

- secondary costs.

The parameters of the cost element, e.g. Recording quantity, Cost element category are specified in the GL account master. Cost elements do not have time dependency, default account assignment, cost element attribute mix anymore.

This picture shows how a GL account for primary costs looks like (double click to enlarge):

Also secondary cost elements are created within a chart of account. Postings on G/L accounts with account type ‘secondary cost elements’ appear directly on the same account in GL reporting. Separate G/L accounts for CO-FI real time reconciliation postings are no longer needed, since inter-company postings will be updated using the secondary cost element rather than rolled up to reconciliation accounts.

The postings recorded for primary of secondary cost elements will be displayed by account number in new FI reports.

Cost objects in SAP S/4 HANA Financials

The CO assignment object is stored in the FI Universal Journal and therefore can be analyzed in the new FI reports on on the line item level.

General Cost Objects and the transactions associated with them are not available in Cost Object Controlling (Intangible Goods and Services) within SAP S/4HANA. They can be replaced with internal order or product cost collectors.

General Cost Objects and the transactions associated with them are not available within SAP S/4HANA in Cost Object Controlling (Product Cost by Period). For aggregation of costs of manufacturing orders and distribution of usage variances the summarization hierarchies and distribution of usage variances function (transaction CKMATDUV and CKACTDUV) can be used instead.

Material Ledger in SAP S/4 HANA Financials

The activation of Material Ledger is mandatory to valuate stock in S/4HANA. The activation of Actual Costing in Material Ledger remains optional.

Material Ledger is setup as a subset of Financial accounting and its postings are updated to the FU Universal Journal.

There are no Material Ledger processes within Inventory management (MM) anymore.

Change in Material Ledger with Actual Costing

The closing process has been simplified and its performance has been significantly improved. The process step „Settlement“ replaces 4 processes – single-level, multi-level price determination, revaluation of WIP and consumption. The variance distribution logic has been improved so that less not-distributed variances occur. The closing can be performed without locking material movements in the current fiscal period. Also the standard price change is now possible during the fiscal period. In the section „Processing“ the status of the activity types is displayed in addition to the status of the materials. The button “Activity Types” for displaying the activity types value flow has been therefore removed.

There is no difference anymore between single-level and multi-level differences. They are aggregated and stored under transaction keys PRD/KDM.

The report „Material Ledger Valuated Quantity Structure“ (transaction CKMLQS) is not available per default but can be activated via notes 2378468 Enable CKMLQS based on table MLDOC and 2495950 CKMLQS: Connection to CKM3

Changes in Alternative validation run

Now it is possible to process a alternative valuation run in transaction CKMLCP using the selection of application.

It is not possible to use delta posting runs anymore. The Cumulate Data step is remote as the cumulation of several periods is done on-the-fly.

The WIP revaluation is now supported in the AVR run.

A new transaction key PRL has been implemented for price differences of activity types with the following posting logic: Cost center variance (GBB/AUI) —> Material Ledger variance (PRL) —> stock/WIP increase/decrease (BSD).

The functionalities of „External Ending Inventory Valuation“, „Cumulated Inventory Valuation“, BAdI CKMLAVR_SIM are available in the current S/4HANA release

Technical changes in Material Ledger

The periodic tables MLHD, MLIT, MLPP, MLPPF, MLCR, MLCRF, MLKEPH, CKMLPP, CKMLCR, MLCD, CKMLMV003, CKMLMV004, CKMLPPWIP, CKMLKEPH are replaced with the new Material Ledger Document tables MLDOC and MLDOCCCS which allow storing both line item and header data. The new tables allow to extend the number of cost components over 40 without a modification.

CO-PA in SAP S/4 HANA Financials

With S/4HANA all CO-PA characteristics are made available in the FI Universal Journal to enable a multi-dimensional analysis of results by profitability dimensions. This functionality replaces the former account-based CO-PA. The cost-based CO-PA can be used further on.

All revenue and cost postings are automatically assigned to the relevant CO-PA characteristics at the time of FI document posting and settlement/allocation in CO and stored in FI Universal Journal. This provides a visibility of the results during the fiscal period already before month-end-closing and eliminates the need for FI-COPA reconciliation.

To be considered that the revenue is recognized at the time of invoicing and cost of goods sold when the delivery is made. If there is a time gap between invoice an delivery a revenue recognition function should be taken in consideration.

In order to see the production order variances by variance categories in account-based CO-PA (scrap, price variances, quantity variances etc.) multiple accounts can be used for production variance settlement.

If the Top-Down-Distribution is used in CO-PA it needs to be extended by account/cost element in the selection criteria.

The incoming sales order quantities and values (record type A) are recorded in an Extension Ledger in for of predictive accounting documents.

Transfer prices in SAP S/4 HANA Financials

The functionality for valuing the transfer of goods or services according to legal, group, or profit center valuation is supported as of SAP S/4 HANA 1610. With the merge of FI and CO into the Universal Journal, a new approach for parallel valuations was implemented:

- transfer prices can be updated within a ledger containing all valuation views or alternatively with

- separate ledgers per valuation view.

Parallel delta versions for actuals in Controlling are used for statistical line items updating table COEP only. All other actual line items updating table ACDOCA use the new data model.

Multiple Valuation of Cost of Goods Manufactured: only the ledger approach is fully supported as of Release S/4 HANA 1610 (Support Package 1 new COGM implementation or Support Package 2 conversion from ERP) however several notes need to be installed to enable an error-free function – please refer to this SAP note for more information. The configuration of the COGM function has been adjusted, e. g. in „Transfer CO postings to FI for parallel valuation“ is obsolet as the real-time integration is activated as default for all valuations and all CO postings always appear in FI.

Important note: this post describes only selected highlights relevant to the current S/4 HANA release and do not cover every aspect of S/4 HANA. For more information please refer to the official SAP Documentation.

Learn more about SAP S/4 HANA: https://agil-on.com/en/sap-s4-hana/

Copyright Ⓒ 2018 Agilon GmbH. All rights reserved.