How Material Ledger works in SAP?

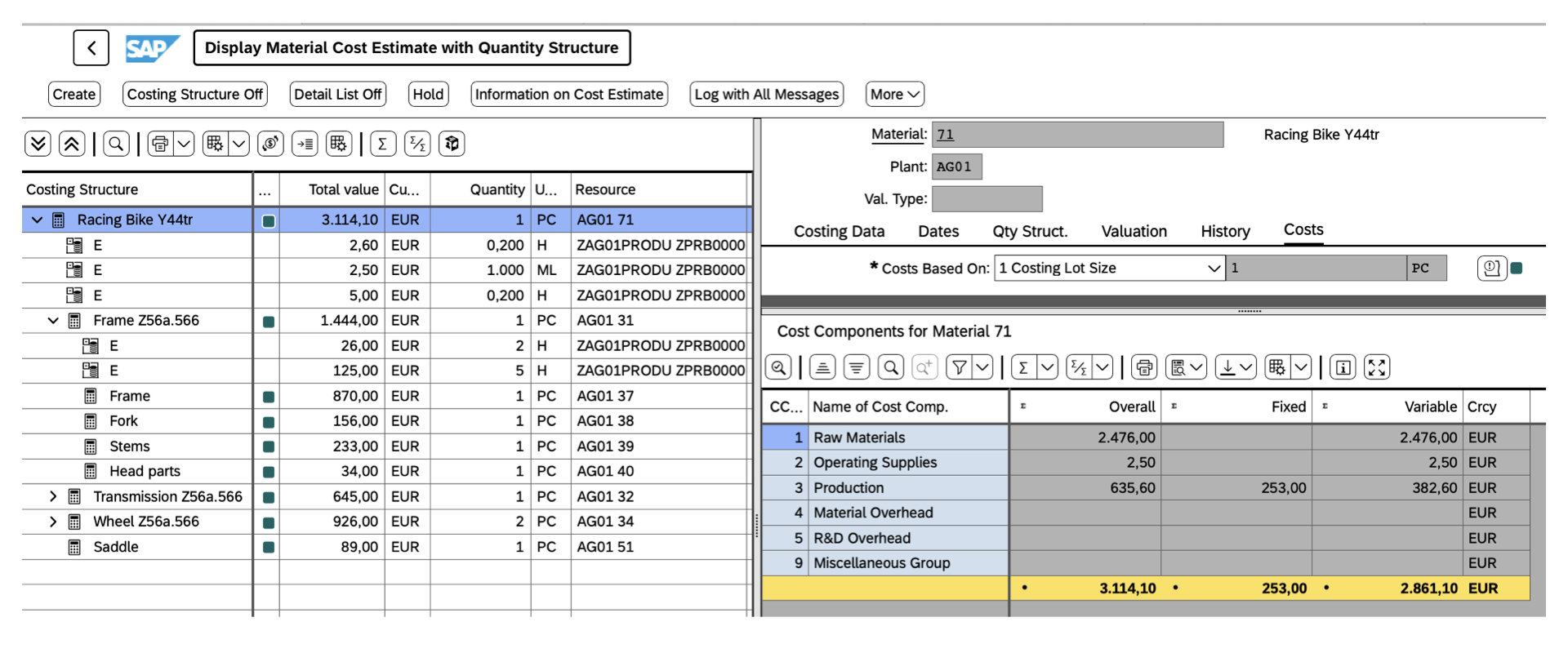

I. The starting point: Standard cost estimate (SAP CO)

The starting point for the Material Ledger actual cost calculation is the release of standard cost estimates for all materials relevant for actual costing. Such materials are raw materials, semi-finished and finished materials that are involved in a manufacturing process.

A standard cost estimate determines the standard prices for finished materials based on the planned costs of the semi-finished and raw materials to be consumed and the planned activity prices for the planned workload.

The standard prices for common stock materials are released once at the beginning of a fiscal period – every month or every year. The release of standard costs for special stock materials is usually done with saving of the underlying object – a sales order or a project – which carries its own specific cost estimate.

Let’s look at an example:

II. Periodic transactions

During a fiscal period, Material Ledger collects data relevant to actual costing – actual quantities and price differences for materials and activities involved in the manufacture of semi-finished and finished products.

Procurement and Material Management (SAP MM)

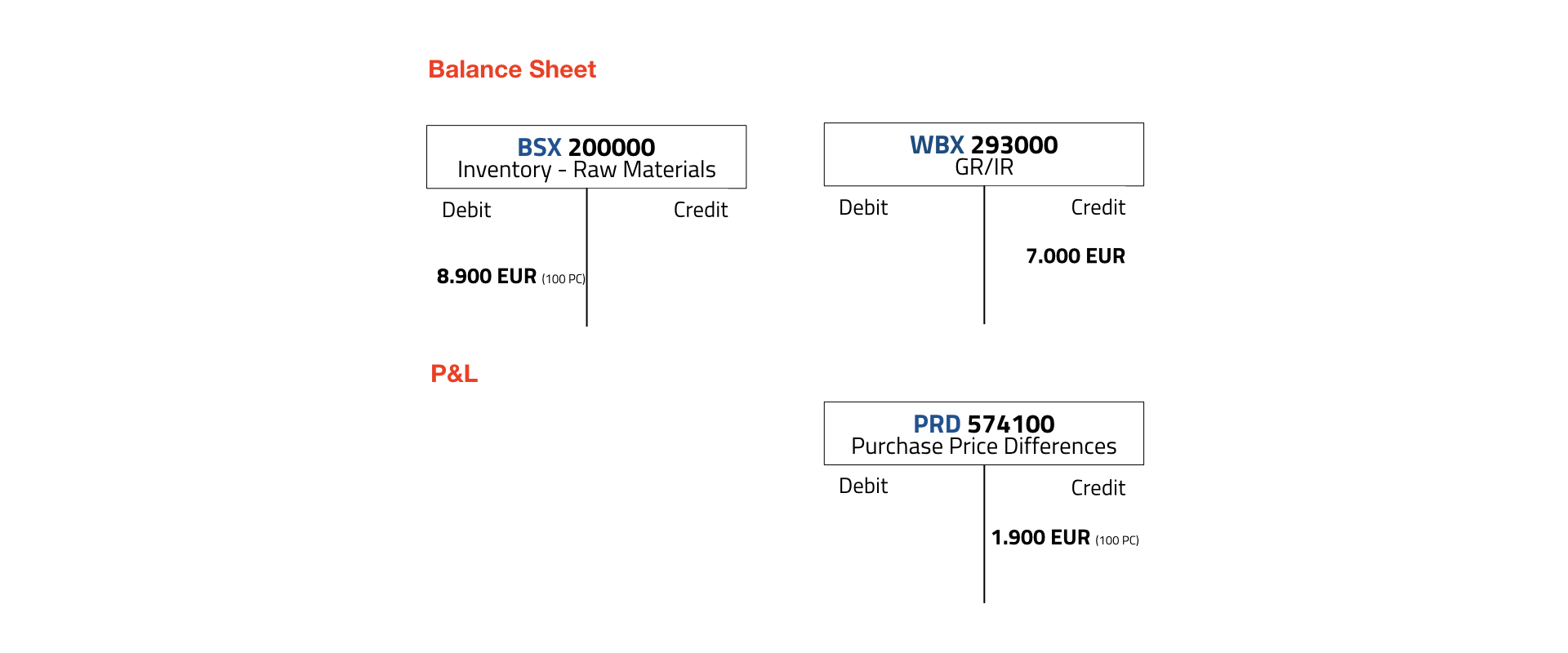

The actual prices for raw materials are determined based on the following procurement documents: purchase orders, goods receipts, invoice receipts, vendor credit/debit memos.

If the purchase price in a purchase order differs from the standard price of a raw material, the difference is considered in the Material Ledger based on the actual price determination. The same applies to invoice/invoice adjustment vs. purchase order price differences.

Example: The material #51 is a raw material required to produce the finished material #71. The standard price for the material #51 is 89 EUR per piece. The price for the purchase order was 70 EUR per piece and 100 pieces have been ordered. With the goods receipt of 100 pieces, a purchase price difference of 1.900 EUR has been posted in accounting and stored in Material Ledger.

The preliminary actual price of the raw material determined by Material Ledger is (100*89 – 1.900)/100 = 70 EUR.

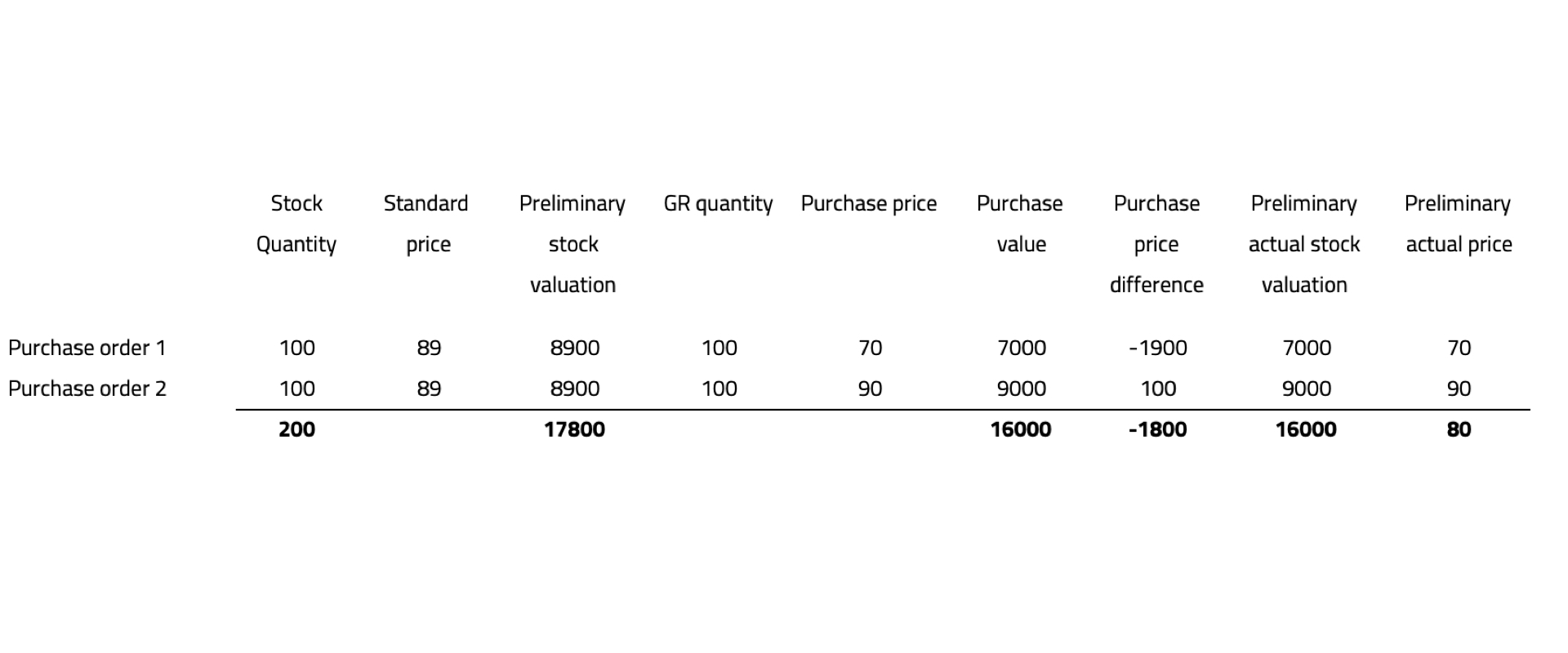

If there are several purchase orders with different prices, the Material Ledger determines the actual price as a moving average, considering all purchase order prices of the relevant fiscal period.

For a second purchase order for 100 pieces at a price of 90 EUR each, the actual price of the material #51 would be equal: ((100*89 – 1.900) + (100*89+100))/(100+100) = 80 EUR:

Production (SAP PP)

During a manufacturing process Material Ledger collects actual quantities of activities confirmed and changes in inventory of materials posted for production orders. All production order confirmations are valuated at the standard price.

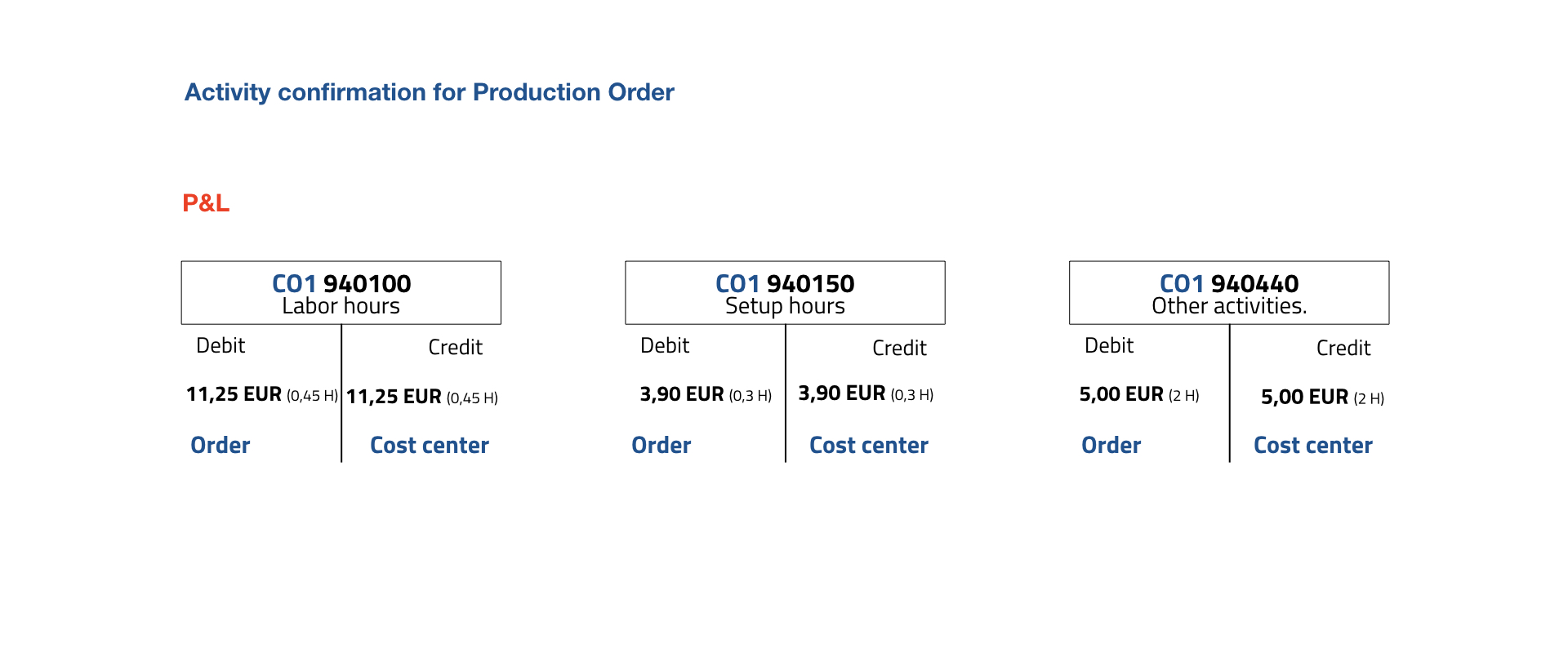

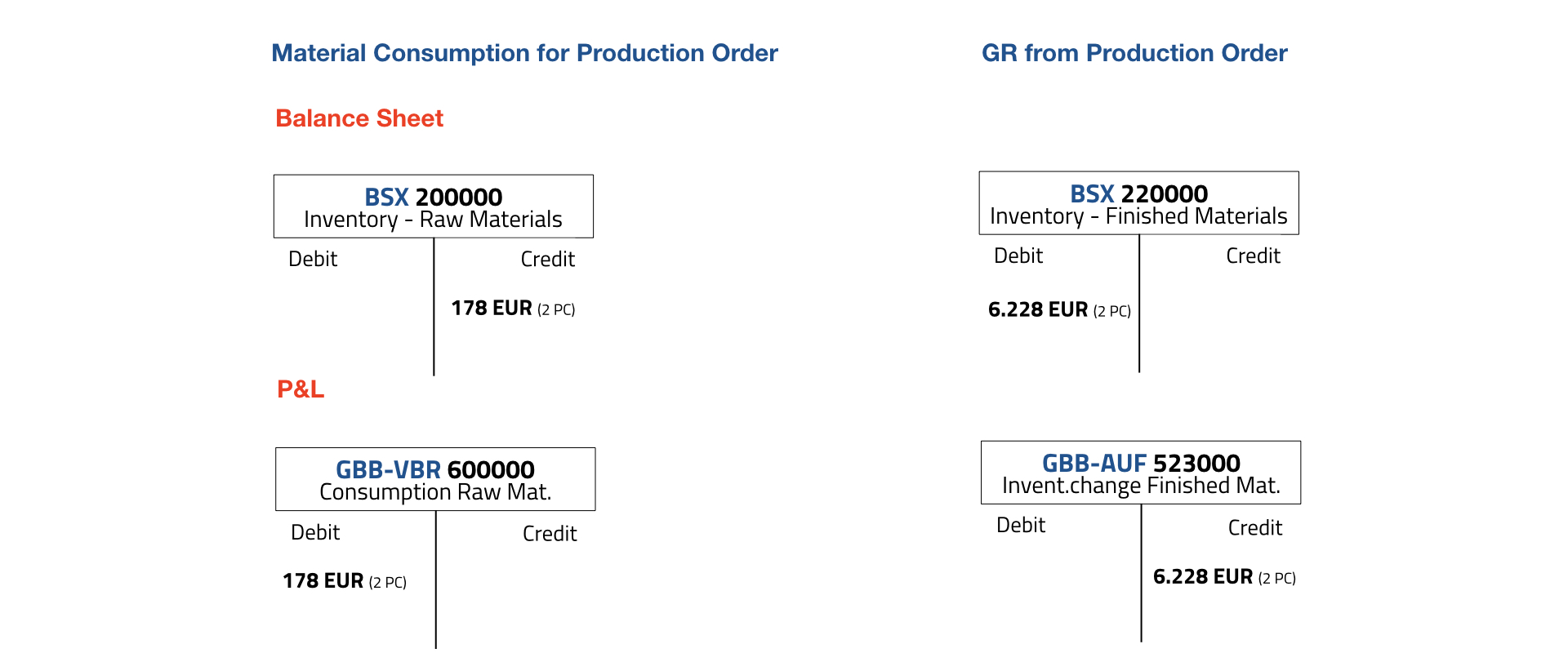

In our example 2 pieces of the raw material #51 were consumed together with three semi-finished materials for a production order. The consumption costs of the raw material were 2 x 89 = 178 EUR. The order has delivered 2 pieces of the finished material #71 at standard price of 3.114 EUR each (6.228 EUR total). Three different activities have been confirmed for the production order – labor, setup, and other activities – all of which were valuated at the planed activity price. The journal entries generated in Financial Accounting are listed here:

Sales (SAP SD)

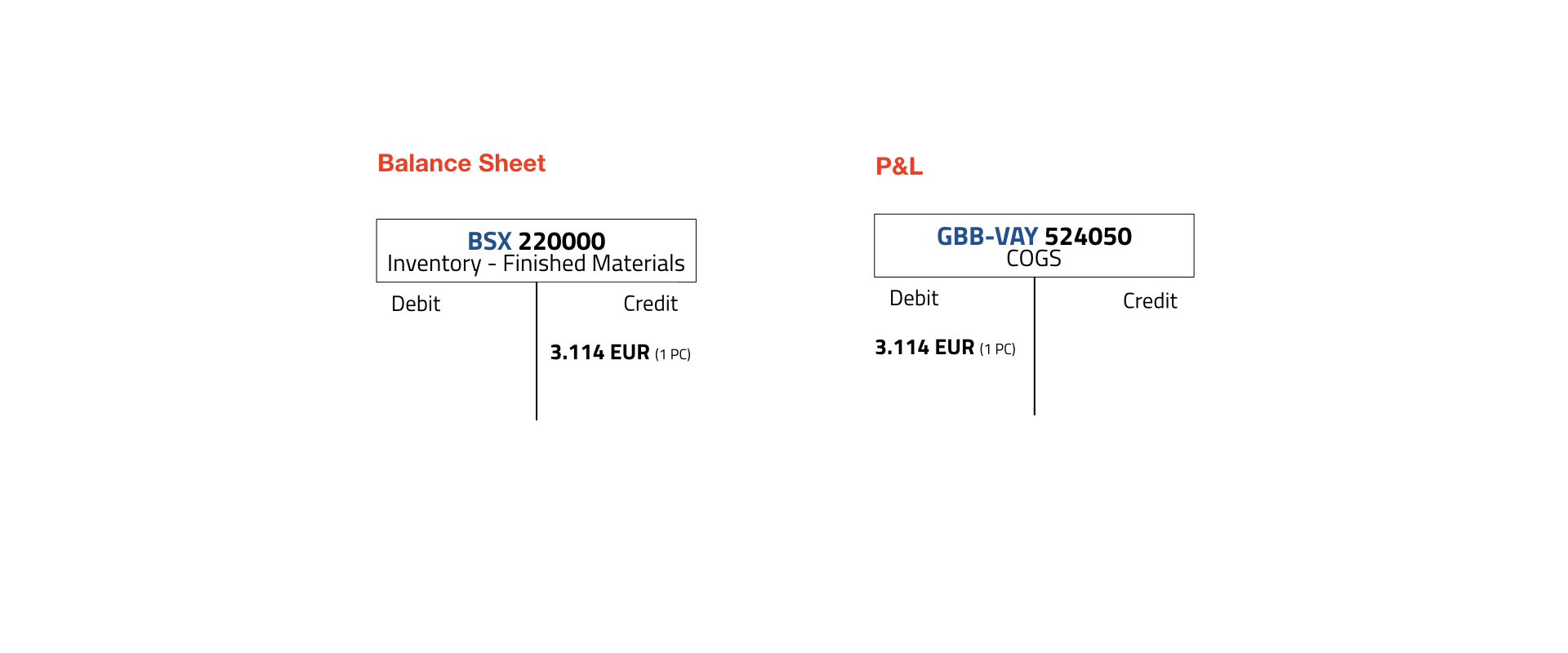

When the finished materials are delivered to a customer, the change in inventory in the material ledger is also updated. The change in inventory is valuated at the standard price.

III. Month-end closing (SAP CO)

At the month-end closing production variances are determined for all production orders delivered within the current period. They correspond to the difference between the target (standard) costs and the value of confirmations posted to the production order within the current fiscal period. Typically, production variances are caused by over/under consumption of activities or materials and/or under-delivery of semi-finished/finished materials e.g. due to defects or scrap.

The production variances are settled to the stock of the material delivered from the respective production order. This transaction updates the price difference of the Material Ledger for the respective material.

After production variances are settled the final actual costs are determined in Material Ledger Actual Costing Cockpit (transaction CKMLCP).

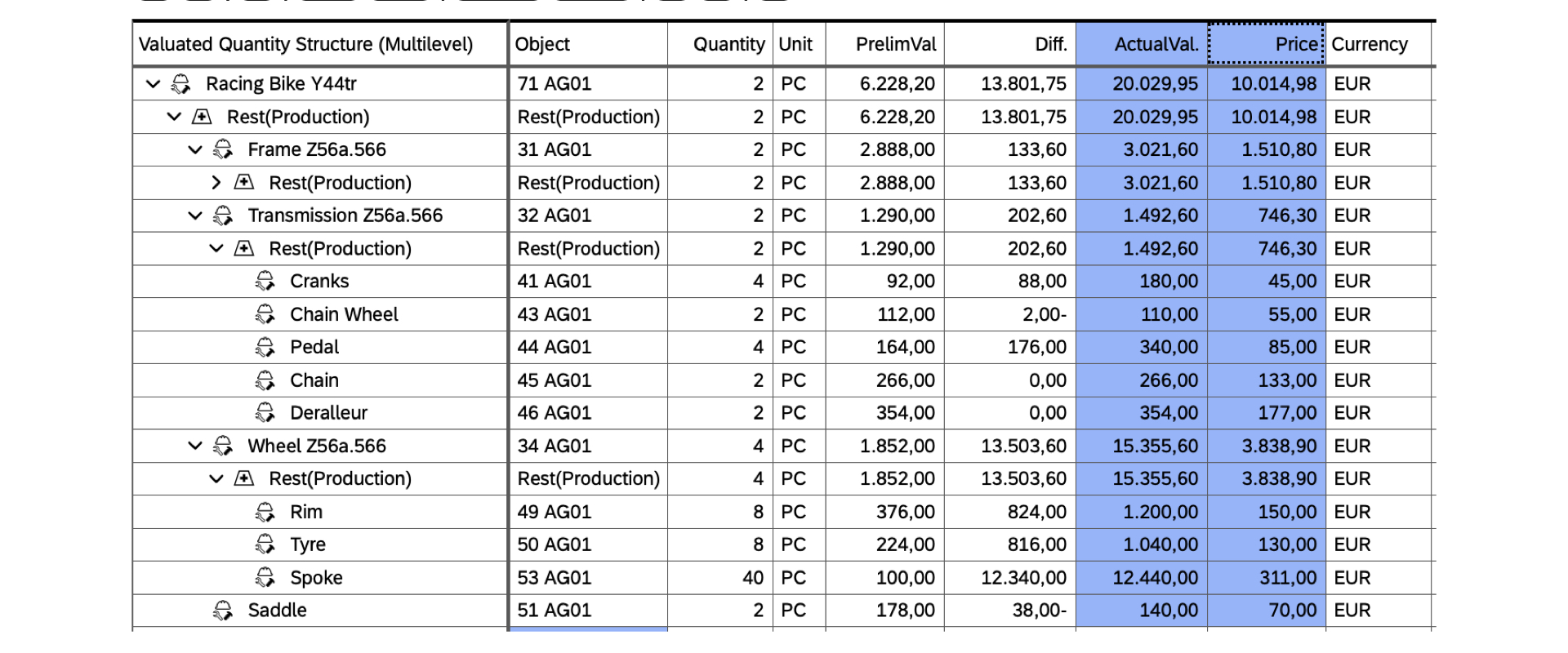

The actual cost determination goes bottom-up: from raw materials to semi-finished materials to finished materials. With Material Ledger multilevel price determination variances occurred on lower levels are rolled-up to upper levels.

In our example the purchase price variance at the level of raw material #51 was divided into the consumed quantities of 2 pieces (1.900/100*2 = 38 EUR) and allocated to the finished material #71. The same applies to the production variances of 0,05 EUR on the last manufacturing level – production of the finished material #71 and variances on other levels.

The actual price of the finished material equals the preliminary valuation value plus all differences divided by the total quantity (6.228 + 13.801)/ 2 = 10.014 EUR.

If the total stock of a finished material has been fully delivered to the customer(s) in the current period, then all its variances, including those rolled-up from lower levels, are allocated to the cost of goods sold of the finished material. When the manufacturing and delivery process is stretched across several fiscal periods, the variances are allocated to the stock of semi-finished and/or finished materials until a delivery made to the customer.

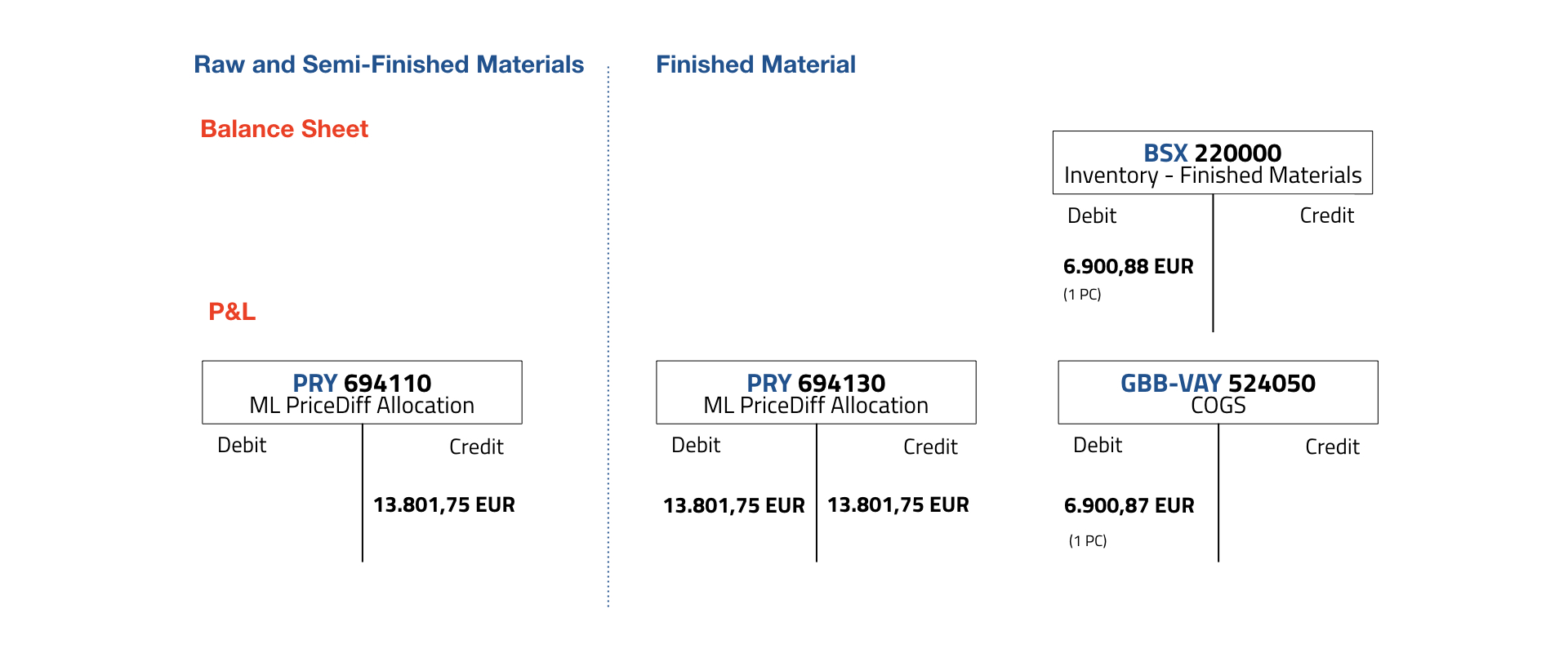

I our example 1 piece was delivered to customer and 1 piece remained in stock. Therefore 50 % (6.900 EUR) of the total variances were allocated to the stock of material #71 and 50% (6.900 EUR) to its costs of goods sold.

The (simplified) closing journal entries show an impact on P&L and balance sheet: