X

Q&A SAP Material Ledger

In this post we want to share questions frequently asked before and during the implementation of SAP Material Ledger.

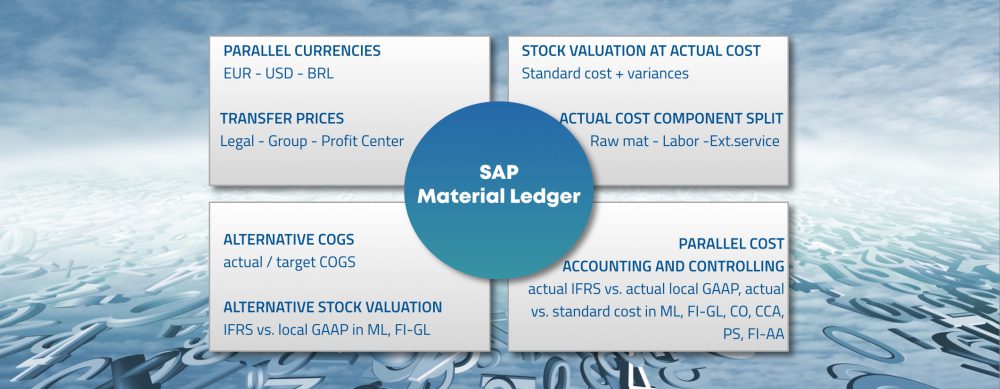

Q: What are the use cases for Material Ledger?

There are following main reasons why companies consider Material Ledger as a necessary functionality for their business:

- they want to valuate material stock in multiple currencies and/or with different valuation prices at the same time, according to different valuation approaches – IFRS, US GAAP, other local GAAP etc.

- they want to valuate material stock at actual prices

- they want to determine alternative costs and results based on alternative prices not used for stock valuation

- they want to automate parallel value flows according to different accounting principles at actual or standard costs in all areas of accounting and controlling

(1) Material Ledger with Parallel Valuations without Actual Costing

allows a material valuation with different prices stored in up to 3 valuation views (legal, group, and profit center view) in the group and the local currency.

The legal valuation is usually used for financial closing and reporting of a single legal entity according to the legal requirements (external view).

The group valuation is used by a group for closing and reporting across legal entity boarders (internal view). The material prices in the group valuation are usually adjusted (corrected downwards) by intercompany profits.

The profit center valuation is used for management reporting, if the entire company is structured by internal areas of responsibilities (profit centers) who deal or compete with each other as if they were independent external companies (alternative internal view). The material prices in the profit center view are usually adjusted by a profit center mark-up or a mark-down.

(2) Material Ledger with periodic Actual Costing

allows a deeper analysis of material price components and material price variances based in relation to the standard price, and an update of material prices, stock values and consumption at actual costs (standard costs plus variances).

With this approach a deep understanding of cost structures through a cost component view as well as the periodic cost development trough variance analysis are possible. See the official SAP docu for more information.

(3) Material Ledger with alternative valuation run

supports a simulation of alternative cost of goods sold and stock values based on alternative material and activity prices which are not used for stock valuation. Such alternative prices can be standard prices of the previous year, future plan prices, purchase prices, stock valuation prices according to alternative GAAP etc. Alternative activity prices from any active planning version can be used.

This functionality can be applied as simulation costing for management reporting and/or as periodic revaluation for the purpose of parallel accounting according to a different valuation principle. See the official SAP docu for more information.

(4) Material Ledger with parallel COGM

allows you not only to setup parallel valuations according to different accounting principles for stock valuation as in case (3) but also to integrate it with Cost Center Accounting and Asset Accounting and General Ledger Accounting. This approach is used when an integrated monthly cycle of Accounting and Controlling with different valuation prices (actual or standard) is required for alternative accounting principles. See the official SAP docu for more information.

Q: What are the risks or disadvantages when you implement Material Ledger?

- increased process complexity and longer duration of the month-end closing esp. in the presence of periodic revaluation run(s)

- performance issues during month.end-closing when you have huge data volumes relevant for Material Ledger

- increased master data and transactional data complexity, esp. when you implement parallel valuations and different valuation prices

- strong discipline in logistical processes and higher data quality is required to satisfy ML data consistency and data quality needs

- not all FICO functionalities are equally available with each Material Ledger approach, so you need to be careful while defining the requirements and choosing the Material Ledger settings. E.g. cost component view is not available without Actual Costing activation and multi-level price determination; settlement of production variances by categories (price/ quantity/ to CO-PA is not possible when you activate periodic Actual Costing as all variances are settled to material as a total; not all FICO functionalities are equally available in all valuation views when you activate parallel valuation in Material Ledger, e.g. the split of variances by variance categories, settling variances by categories to Profitability analysis only supported in the leading valuation

- some of basic Material Ledger settings incl. its activation are irreversible once you activate them in a productive system, under certain circumstances their change or deactivation can be performed only by SAP personnel for additional fees.

Q: What impact does Material Ledger has on the material price control?

The following dependencies should be considered when activating Material Ledger:

(1) Material Ledger with Parallel valuations without Actual Costing: material price determination is transaction-based; material prices are determined and updated real-time for each valuation when posting a material transaction. Material price control is set according to the strategy of the company, usually a moving average price (V) is applied to all internally or externally purchased materials e.g. raw materials, purchased spare parts, and a standard price (S) is applied to materials manufactured internally, e.g. semi-finished and finished goods.

(2) Material Ledger with Actual Costing: material price determination is multi-level or single-level, material prices are updated periodically at month-end closing. Material price control standard price (S) is applied to materials (raw materials, semi-finished and finished goods) which are involved in the manufacturing process and which price variances need to be included in the actual price of finished good. The multi-level price determination is applied when price variances need to be rolled up from the low level to the upper level material in the multilevel BOMs.

Q: Which valuation approach is recommended as the leading approach when using parallel valuations in Material Ledger?

Usually the legal valuation is used as the leading valuation due to the constraint, that some processes are not supported in non-leading valuations but need to be applied as per legal or internal requirements, e.g.:

- WIP calculation for target costs is only possible on the basis of the leading version,

- cost and revenue recognition in project and order result analysis is done on the basis of the leading valuation plan values,

- plan activity costs are estimated on the basis of leading valuation prices,

- variance calculation determines variance categories only for the leading version. For the additional valuation approaches, the variances are only available as a sum via the price difference account.

Q: What is the impact of Material Ledger on the month-end closing process?

Additional closing steps to be considered:

(1) Material Ledger with Parallel valuations without Actual Costing:

- Run material costing/update material prices for parallel valuations,

- Run result analysis and settlement for parallel valuations.

(2) Material Ledger with Actual Costing: below is an example process based on the requirement to determine the actual price for all materials including all material price variances of the closing period and to update the standard price = actual price with validity for the next fiscal period:

- a. CKMLCP: Material selection for closing

- b. CKMLCP: Single-level price determination

- c. CKMLCP: Multi-level price determination

- d. CKMLCP: Revaluation of consumption

- e. CKMLCP: WIP revaluation

The prerequisite to allocate variances to WIP correctly is that all WIPs have been completely posted for all production orders, projects and sales orders. The project controllers’ team can check the WIP posted against WIP determined in the result analysis.

- f. CKMVFM: Check value flow monitor: Not distributed and Not allocated variances: should be zero

- g. MR22: Distribute variances to material manually, if not distributed variances zero

- h. CKMLCP: Check/Rerun WIP/Revaluation of consumption

- i. CKMLCP: Mark material prices: select a validity date to a date before the end of the calendar period which you are closing

- j. CKMLCP/overview costing run: check material status, variances between the standard and the actual price

- k. MMPV: Close current period, open next period in MM

- l. MM03: Check if the future price in material master equal to the actual price of the closing period

- m. OB52: Open the new posting period in FI

- n. CK40n: Create and released standard cost estimate (applied to materials with standard cost estimate: semi-finished and finished materials)

- o. CKME: Release material actual price to standard price (applied to materials w/o standard cost estimate)

- p. CKMLCP: Post ML closing documents

- q. CKMLCP/overview costing run: Check material status and errors.

- r. CKMLCP: Eliminate errors if any and rerun closing postings

- s. FAGLB03: Check ML account balances: ideally the total balance of the price variance and variance offset accounts should be zero after Material Ledger Actual Costing closing postings.

- t. KKAJ, CJ88/VA88: Once Material Ledger actual costing closing entries have been posted the cost objects impacted by consumption revaluation, e.g. WBS elements, network activities of projects, sales orders, cost centers need to be recalculated and settled– rerun result analysis and settlement to update the results with actual costs.

Dependent on the requirements some of the above steps may not be necessary. E.g if you do not update material prices and just revaluate stocks you only need 1-h, j-k, m, p-t steps. If you do not have any impacted cost objects you skip step t.

Q: How are logistical processes integrated with Material Ledger? What needs to be considered when defining logistical processes?

Material Ledger is closely integrated with Material Management (MM), Production planning and execution (PP), and with Sales and Distribution (SD). In order to achieve the desired results with Material Ledger, esp. when Actual Costing is activated, it is important that logistical processes follow the best practices and stick to the established rules, e.g.:

- goods receipt posting before invoice receipt posting for each purchased item in each posting period: there should be a stock unequal to zero when an invoice with price differences is posted,

- no production order release before release of the header material cost estimate,

- no production order confirmations or goods receipt in the period subsequent to the period of the final order closing/settlement,

- no order delivery to stock, to project or to customer until all manufacturing costs are fully posted to the order,

- no customer returns without the reference to the original order item.

Q: How to analyze if all material price variances are allocated correctly to the materials at month-end?

First, check the relevant account balances in FI (e.g. in FAGLB03 report): ideally the total balance of all price variance and variance offset accounts should be zero after Material Ledger Actual Costing closing postings. In this case Material Ledger has successfully allocated all variances either to inventories, WIP or material consumption (costs of projects / orders).The following MM/FI accounts are to be considered in this reconciliation:

Price variance accounts:

- PRD: purchase price variance and production variance

- KDM: exchange rate difference

- AUM: difference from material stock transfer

Variance offset tough ML closing:

- PRV, PRY, PRM: single-level, multi-level differences and WIP revaluation offset

- KDV: exchange rate differences from the low level material revaluation.

Second, in case the total balance is not zero, further analysis can be done with the help of Material Ledger Value Flow Monitor. (CKMVFM). It provides a good overview whether and how variances have been allocated/distributed. Trough the drill-down function it is possible to find the root cause – mostly a process or master data issue in the related logistical processes, and to define actions to eliminate the identified issues.

Q: What are the causes of not allocated /not distributed variances?

Not distributed variances

are originated from the initial inventory/goods receipts. They are not considered in the actual price as Material Ledger considers them as price distorting or prevents a negative actual price.

They occur when

- variance amount is higher than the value of cumulative inventory at standard price. This can be caused by ether a wrong standard price (e.g. zero), wrong variance (e.g. when qualities in goods – receipts lower that quantities in invoice receipts), periodic shift of goods receipts and invoice receipts, manual posting on variance accounts to materials without stock in the posting period

- changes in the price control of materials during the posting period with transaction CKMM

- change of the valuation class or profit center in material master during the posting period

- late standard price change with transaction MR21.

Not allocated variances

are originated from the consumption and multi-level rollup side and mean that Material Ledger was not able to allocated them neither to the stock on the material level, nor to the stock on the subsequent levels nor to any costs object.

They occur when

- Material Ledger closing has not been fully performed esp. with regard to revaluation of consumption, WIP or multi-level price determination, or not performed for some materials and plants, or not fully re-processed

- a subsequent material in the multi-level price determination has wrong price control (e.g. price determination 2, price control V)

- the multi-level price determination was cut off due to a high number of cycles. this happens e.g. when a material is involved in cyclical processes (multiple reworks, back-and-forth stock transfers).

- in a scenario with periodic production orders without WIP, consumption without goods receipts are posted in the posting period, goods receipts posted in the next period

Q: What are the prerequisites to use the Material Ledger alternative valuation run for the purpose of alternative cost simulation?

First, you need to determine the valuation strategy for the alternative valuation run:

- Will materials be valuated with a different price than that in the periodic material ledger run?

- What is the source of this price – material master, external price tables, ML other periods, FIFO/LIFO prices, other prices?

- Will activities be valuated with a different price than that in the periodic material ledger run?

- What is the source of this price – actual vs. plan, which CO version?

- How will these alternative values be used – ML stock values report, CO-PA alternative operating results, FI parallel ledger report etc.

- Do the alternative costs need to be posted to FI and updated in CO on costs centers?

- Do you run it for a single period or for several periods?

Customizing prerequisites:

- basics: Activate Material Ledger and Actual costing with actual cost component split

- in order to use alternative material prices you need to setup a valuation alternative in transaction OMWEB with final result „C“- relevant for external cumulative valuation in Material Ledger. In addition you need to implement the OSS note 997262 BAdI BADI_ENDING_INV.

- in order to use alternative activity prices you need to setup CO versions in Controlling and enable the actual activity update with indicator „1“ in transaction „Activate Actual Costing“ . If actual activity prices shall be used you need to set this indicator (e.g. 5) in the relevant activity types in transaction KL02.

- in order to transfer the alternative costs to CO-PA define a define a costing key and assign it to the relevant accounting principle in the transaction „Set-up transfer of cost component split to CO-PA“. In CO-PA customizing define which value fields should receive costs from this costing key.

Typical process for simulation run (posting run: no, revaluation consumption: yes, acc. modification: blank, acc. principle: blank):

- a. CKMLCP Complete the periodic Material Ledger closing

- b. KSII Actual activity price calculation

- c. MRY2 Transfer Physical Inventory Prices to Material Ledger valuation alternative

- d. CKMLCPAVR Data selection

- e. CKMLCPAVR Cumulate data

- f. CKMLCPAVR Determine sequence

- g. CKMLCPAVR Single-level price determination

- h. CKMLCPAVR Multi price determination

- i. CKMLCPAVR Revaluate consumption

The results you can see directly in CKMLCPAVR transaction of in CKM3 (select the AVR run) or in the value flow monitor CKMVFM (select the AVR run).

Q: What are the prerequisites to use the Material Ledger alternative valuation run to revaluate stocks according to alternative accounting principle in a non-leading ledger?

In addition to the customizing described in the previous chapter you need to define stock accounts for BSD account in OBYC transaction and to set up a non-leading ledger and an accounting principle in FI new General Ledger.

Typical process for a posting run (posting run: yes, revaluation consumption: no, acc. modification: BSD, acc. principle: local:

- steps 1-h

- j. CKMLCPAVR Determine delta posting

- k. CKMLCPAVR Post closing

The results you can see directly in CKMLCPAVR transaction of in CKM3 (select the AVR run) or in the value flow monitor CKMVFM (select the AVR run) as well as in Financial accounting reports by selection the respective non-leading ledger. See the official SAP docu for more information.

Learn more about SAP Material Ledger: https://agil-on.com/en/sap-material-ledger/

Copyright Ⓒ 2018 Agilon GmbH. All rights reserved.